As we enter the holiday season, here is a review of the economic situation. It is not good.

After the recent rate hikes, a market-news service explained succinctly what is going on and what to expect.

The worst year for stocks since 2008 could still get uglier, as the Fed’s effort to pull potentially trillions of

dollars out of financial markets hits full steam, Matt writes.

Driving the news: The Fed opened up the second front in its war against inflation in recent months,

moving to shrink its stockpile of nearly $9 trillion worth of U.S. government bonds — a process known as

quantitative tightening.

In September it upped the rate at which it’s cutting its holdings, to nearly $100 billion a month.

The Fed also continues to lift short-term interest rates, delivering its third consecutive hike of 0.75

percentage points yesterday.

Why it matters: The only previous attempt by the Fed to simultaneously raise rates and decrease its

holdings of government bonds coincided with an ugly 20% stock market sell-off in late 2018.

The S&P 500 is already down 21% from its peak early this year, after the Fed launched its effort to

crush inflation by lifting short-term interest rates.

The big question: With quantitative tightening just ramping up, is the other shoe about to drop on

the market?

. . . The bottom line: Now that the Fed is shrinking its balance sheet — effectively pulling a cool $100

billion out of financial markets every month — some expect the massive pandemic-era tailwind to turn into

a massive headwind for an already troubled stock market.

Axios Markets · Sep 22, 2022

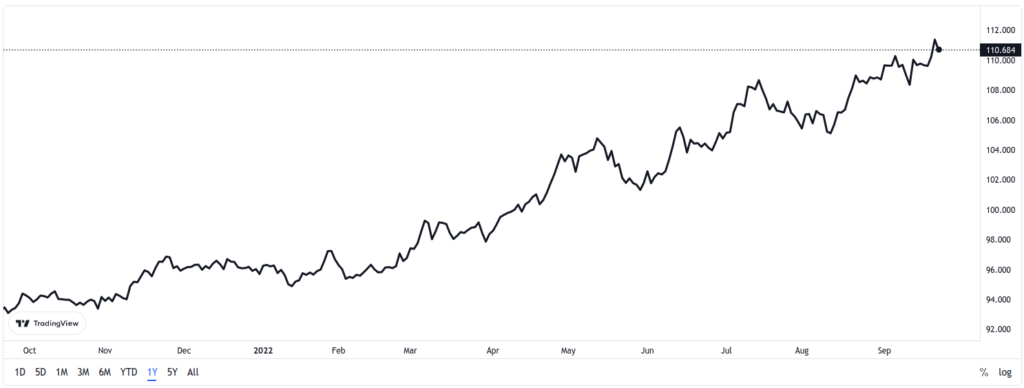

We may not be making any money on paper, but for international clients keeping wealth is stable US Dollars

has been a winner. Accumulating Dollars is currently profitable, as seen by the DXY index. Most 21CA

accounts are over 85% in cash.

The U.S. Dollar Index tracks the strength of the dollar against a basket of major currencies. DXY was

originally developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted

average value of the U.S. dollar against global currencies. U.S. Dollar Index goes up when the U.S. dollar

gains “strength” (value), compared to other currencies. https://www.tradingview.com/symbols/TVC-DX

https://www.tradingview.com/symbols/TVC-DX

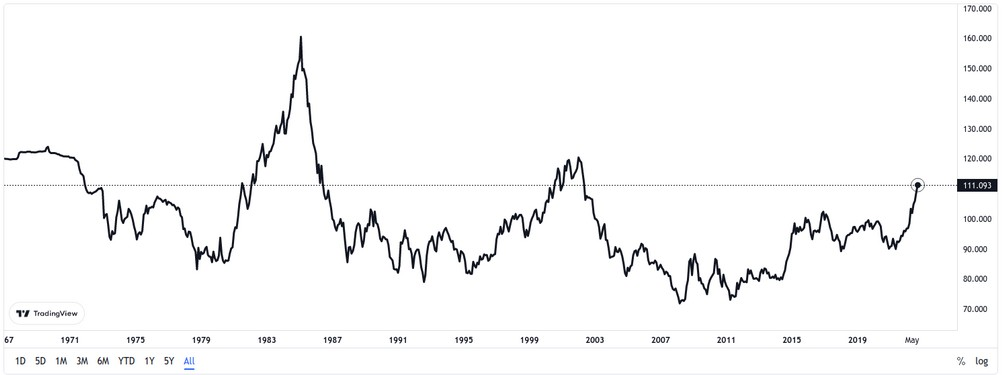

This index has strengthened over the last year by over 18%, since the beginning of the year by 13%, and in

the last 3 months by 6%. Here is the history of this index since 1967, to give you a better idea of what it has

done over the years. Most of the time other major currencies have done better than the US Dollar.

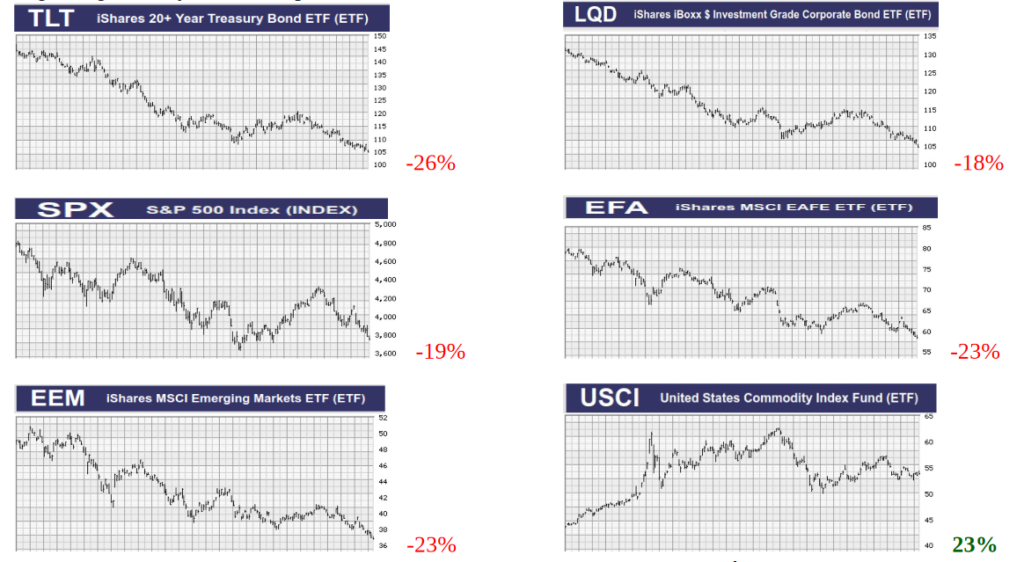

To give you some idea of the trend in almost all areas, here are updated graphs. These are results from the

beginning of this year until Sept 21

May we all see, and experience, only good things in the coming year.

By the way, remember the fund we told you about some months ago? It now holds only a fifth of a Trillion

Dollars of assets and is showing a huge downturn despite its well compensated professional managers,

analysts and promoters.

-28% for this year

Perhaps Americas largest public, retail, fund is one of Vanguard’s famous index funds. According to

Investopedia, it still holds $1.3 trillion of investor assets.

-20%

The PIMCO Total Return Bond fund is reported to be one of the biggest public, retail, bond funds in

America. PIMCO is considered one of the top Bond specialists.

-13%

Kiplinger magazine rated the following among the best mutual funds of all time,

(https://www.kiplinger.com/slideshow/investing/t041-s001-the-25-best-mutual-funds-of-all-time/index.html), The very first,

best of the best, on the list is Fidelity’s Growth Company Fund.

-31%

The second on the list, Fidelity® Select IT Services, is down -30%/

The third fund is the above listed Growth Fund of America.

The fourth is a managed Vanguard fund, PRIMECAP Investor, -20%

The fifth placed fund is Delaware Smid Cap Growth A, -41%

A year ago Yahoo!Finance ran an article (https://finance.yahoo.com/news/10-best-mutual-funds-2021-211740021.html)

giving what they felt were the 10 best mutual funds to own in 2021. Here is how they have done.

YtD return 1 year return

1 Bridgeway Small Cap Value Fund (NASDAQ: BRSVX) is a Texas-based mutual fund that invests at

least 80% of net assets in companies with small market capitalizations in the United States. The fund is

ranked first on our list of 10 best mutual funds for 2021. -10.32 1.14

2 DFA U.S. Small Cap Value Portfolio Institutional Class (NASDAQ: DFSVX) is a California-based

mutual fund that invests at least 80% of net assets in companies with small market capitalizations in the

United States. -9.60 1.01

3 Bridgeway Ultra Small Company Market Fund (NASDAQ: BRSIX) invests at least 80% of net assets

in companies with ultra-small market capitalizations in the United States. -22.31 -26.72

4 MassMutual Small Company Value Fund Class I (NASDAQ: MSVZX) is a Springfield-based mutual

fund that invests at least 80% of net assets in small cap firms as represented by the S&P Small Cap 600

Index or the Russell 2000 Index. -18.52 -10.23

5 American Century Small Cap Value Fund R6 Class (NASDAQ: ASVDX) is a Kansas City-based

mutual fund that invests at least 80% of net assets in firms with small market capitalizations on the S&P

Small Cap 600 Index or the Russell 2000 Index. The fund is ranked fifth on our list of 10 best mutual funds

for 2021. -17.30 -8.46

6 Hartford Small Cap Value Fund Class R5 (NASDAQ: HSMTX) invests at least 80% of net assets in

stocks that have small market capitalizations. -15.87 -9.86

7 DFA U.S. Targeted Value Portfolio Institutional Class (NASDAQ: c) is a California-based mutual fund

that invests at least 80% of net assets in small cap stocks that the fund believes are undervalued and

represent upside potential. -10.25 -0.16

8 AB Small Cap Value Portfolio Advisor Class (NASDAQ: SCYVX) is a California-based mutual fund

that invests at least 80% of net assets in firms with small market capitalizations as seen on the Russell

2000 Value Index. -18.83 -10.84

9 Columbia Small Cap Value Fund I Institutional 2 Class (NASDAQ: CUURX) invests at least 80% of

net assets in stocks present on the Russell 2000 Value Index. -13.85 -7.79

10 JPMorgan Small Cap Value Fund Class R5 (NASDAQ: JSVRX) invests at least 80% of net assets in

stocks present on the Russell 2000 Value Index. -15.27 -7.72

Source of performance data: Morningstar.com

If the above are the best out there, how well is the average fund (and America’s investors) doing? Sadly,

most of the rest of the World is doing considerably worse.