Blinders-based thinking.

Two centuries ago the only mode of transportation in Western countries, other than one’s own feet, was by horse power. In order for horses, particularly in urban areas, not to be easily distracted, Blinders were put on their harness so they could only look straight ahead and concentrate on where to put their feet; allowing the driver to make the important decisions.

Every day our team looks at market reports, and it appears that most ‘experts’ are wearing Blinders. Attached is such a report from Fidelity, one of the very biggest and most investor friendly investment houses. The background information is excellent, however the implementation seems blinkered. When normal systems no longer work, they do not seem able to move out of their tunnel vision way of thinking. As we have mentioned in the past, it is necessary to have a Plan B, in case what you are habitually doing becomes counter productive.

According to the article, we are in an extended period of lower returns. 21CA agrees that we have entered a period of ‘Lean Years’, after a long period of investment success. The war in Europe will probably continue, and even if ended soon will cause an extended period of reduced abundance, as the West participates in rebuilding the country. There is no plan being implemented to slow the climate and ecological disasters facing the planet. America and other countries are seeing their societies fragment, due to numerous factors, including homelessness resulting from spiraling housing prices, opioids, and declining public health. This weakening in the leading countries creates, inevitably, worldwide instability. The World has entered a difficult period.

The enclosed article acknowledges all of this, but comes up with few original solutions other than to reweigh individually built portfolios a little bit this way or that way. Yet the same Fidelity manager highlighted in the article, when asked what to do on LinkedIn, recently indicated to put significant assets not in a balanced fund, but a conservative Fidelity sector fund dealing with Real Estate. Most Money Managers seem to be stuck in their thinking or are constrained by forces beyond their control. Fidelity has a series of Target Risk portfolios available to the American public that would seem to be able to match up personal needs with good managers. However, no specific Fidelity funds were recommended by their staff writer and the consulted Fidelity experts. Are we to infer that individually built portfolios will do better than their fund managers?

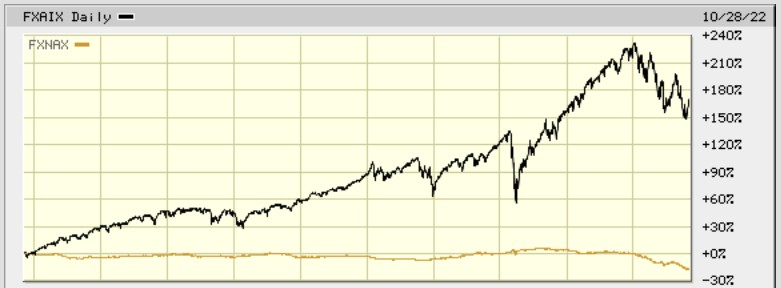

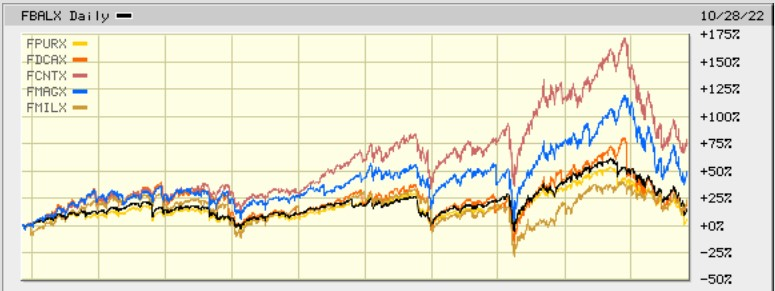

When looking at the over 500 funds that Fidelity offers the American public, performance is not great. On the next page, at the end of the list, compare the managed funds listed with their non-managed index funds. The chances of staying significantly ahead of inflation and taxes via any vendor’s managed funds, especially this year, is not reassuring. (Fidelity was chosen for comparison because it is one of the largest retail investment managers with a long recognized tradition of doing thorough research and analysis. Their funds are consistently above average.)

So what is wrong? Managers, and the public, seem unable to understand that at times Cash is the most important (and safest) investment; and most Managers fail to have an alternative path when markets experience lengthy contraction, which happens every several decades. Without the manager having an emergency plan, any recent gains have been allowed to disappear. Why pay for inadequate management? The stats on the next page indicate few managers have an all-weather approach that produces decent long-term results.

Current market conditions indicate that our Technical Trading approach is weathering the storm. In normal times accounts would have no more than 20% in Cash. However, in these difficult times, most client accounts now have about 85% in Cash. The balance is invested in specific market strategies that have been successful in recent months, plus taking advantage of the strength of the US Dollar.

Target Risk

(This is how Fidelity categorizes these funds) 5 year avge returns 2022 returns Morningstar Rating Fidelity Asset Manager® 20% (FASIX) +1.76% -11.87% ★★★★

Fidelity Asset Manager® 30% (FTANX) +2.30% -14.11% ★★★★

Fidelity Asset Manager® 40% (FFANX) +2.85% -15.53% ★★★★

Fidelity Asset Manager® 50% (FASMX) +3.24% -16.93% ★★★

Fidelity Asset Manager® 60% (FSANX) +3.65% -18.29% ★★★

Fidelity Asset Manager® 70% (FASGX) +4.15% -18.93% ★★★★

Fidelity Asset Manager 85% (FAMRX) +4.82% -20.61% ★★★★

Income and Real Return Strategies

| Fidelity® Strategic Income Fund (FADMX) | +0.95% | -13.11% | ★★★★★ |

| Fidelity® Strategic Dividend & Income® (FSDIX) | +5.03% | -11.50% | ★★★★★ |

| Fidelity® Strategic Real Return Fund (FSRRX) | +3.91% | -4.29% | ★★★★★ |

| Fidelity® Multi-Asset Income Fund (FMSDX) | +7.09% | -14.62% | ★★★★ |

| Balanced Allocation Fidelity® Balanced Fund (FBALX) | +6.87% | -18.06% | ★★★★ |

| Fidelity® Puritan® Fund (FPURX) | +6.29% | -17.33% | ★★★★ |

| Go-Anywhere Fidelity® Capital Appreciation Fund (FDCAX) | +10.12% | -20.87% | ★★★★ |

| Fidelity® Contrafund® (FCNTX) | +7.89% | -27.00% | ★★★★ |

| Fidelity® Magellan® Fund (FMAGX) | +9.10% | -27.00% | ★★★★ |

| Fidelity® New Millennium Fund (FMILX) | +7.37% | -2.33% | ★★★★ |

| The Market Fidelity® 500 Index Fund (FXAIX) | +9.23% | -17.10% | ★★★★ |

| Fidelity® U.S. Bond Index Fund (FXNAX) | -0.28% | -15.23% | ★★★★ |