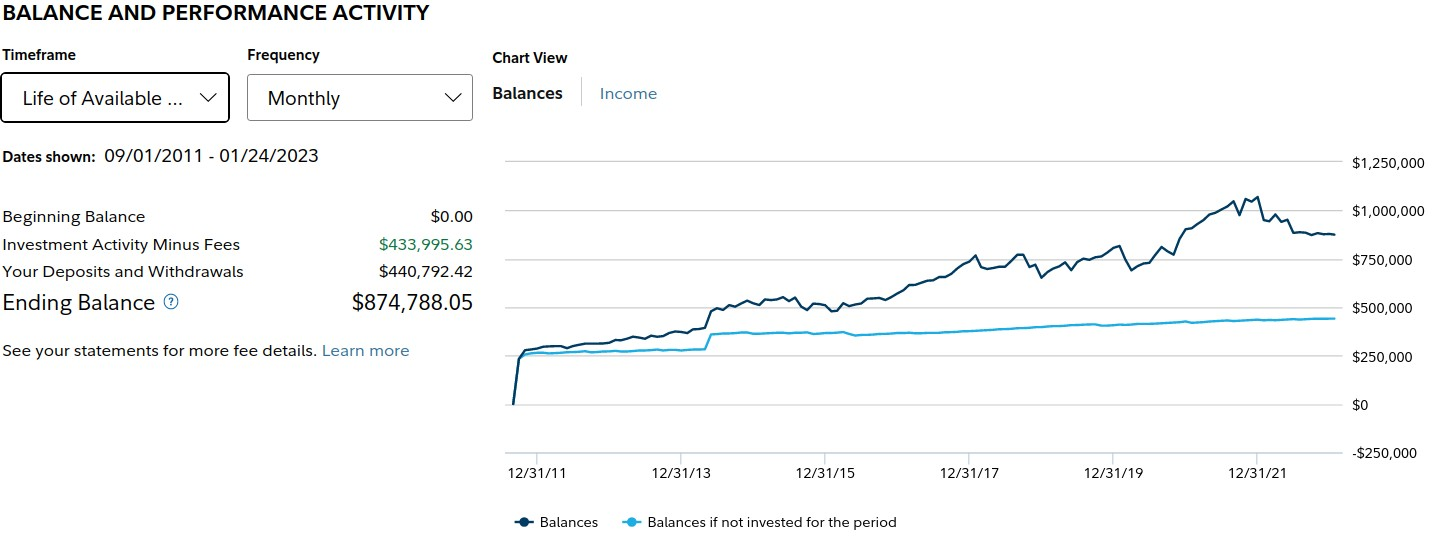

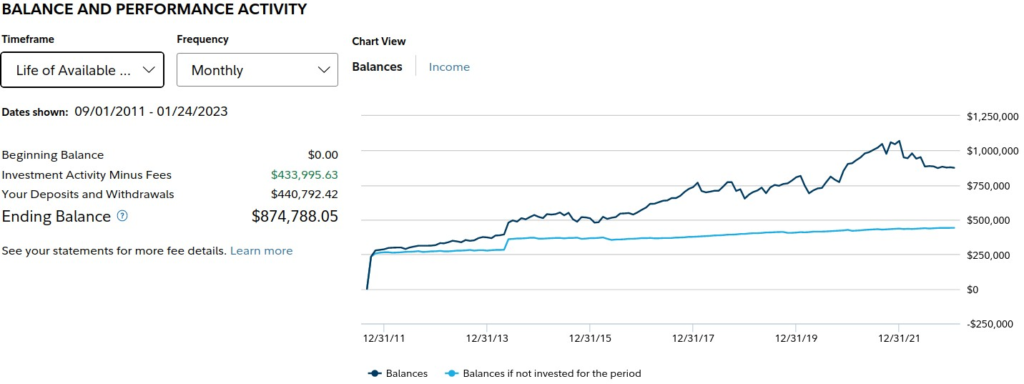

Below are the returns for a 97 year old client. The account generally has high levels of Cash. The

account is mainly in ETFs; some CEFs, a few Mutual Funds, plus some high quality equities. Often

there are over 30 securities in the account representing many thousands of underlying shares, bonds,

commodities and similar types of investments from around the World.

We feel Technical Trading is the ideal money management system for core investing. It can combine

day-to-day banking and a robust investment process in a single account that can be followed in real

time and is always liquid – all at extremely low costs and above average returns.

The strategy in most cases can include the following features:

✓ Instant liquidity and access to most if not all funds,

via cheques, VISA cards or wire transfers.

✓ Banking, with upside gains as good or better than

many market indices.

✓ Safety 1: Much of the time the strategy keeps the

account safely in high levels of Cash. When markets

turn sour the account goes largely into cash.

✓ Safety 2: Very active management, limits downside

risk. All positions have an exit plan in place at the

custodian.

✓ Safety 3: The accounts are covered by US sponsored

protection of $0.5mln/account.

✓ Invest in rising industries and economies before they

hit the news.

✓ Broadly diversified portfolios, representing thousands

of individual holdings in up-markets; and sitting in cash

with much of assets in uncertain markets.

✓ 24/7 client assistance, from most places in the world,

via toll – free calling, or via the internet.

✓ Access to everything via checking and VISA cards.

All recorded on one simple monthly statement.

✓ No churning of accounts, because 21CA is paid only

via a simple management agreement.

✓ Low transactional costs & no ongoing custodial costs

There are three version of the investment strategy, Conservative, Moderate and Aggressive.

Interested in knowing more? Lets begin a conversation.