Lets start with the answer to the second and, for every reader, the more important question.

The answer is Yes & No.

Yes, this may be a significant problem.

If your money is in an American bank or broker and the value

of the account is over $0.25mln1

If your money is in a non-US bank and you are over the limit

of that country’s insurance scheme.2

If your bank has allowed accounts to be opened with crypto-

currencies.

If you have your money in non guaranteed savings plans.3

If your bank has drunk their Central Bank’s ‘Kool Aid’, and

has not properly diversified its Bond Portfolio.4

If the fintech firms you are using for payroll, bank transfers or

other services does its work via one of these problematic banks.

No, I need not be overly worried.

If the assets I have in the bank are less than the amount

that is assured by the government.

If I use a bank or institution that is ‘too big to fail’.5

If I have enough money available for the next few weeks, to

weather this unpleasant but probably not catastrophic

storm.6

1 If you have more than this amount in a single account, the excess is subject to risk of bank failure and part of it could be

lost or impounded until the bank becomes solvent again. In many American brokerage accounts only the cash portion

that is over the insurance limit is at risk. The securities are protected under a separate insurance program.

2 Most western countries have similar guarantees but at a much lower level. For instance, in the UK it is £80,000. In

many countries the guarantee is per taxpayer at that bank, not per account as it is in the USA.

3 Not all bank savings plans are covered by their protection plans, so they can offer higher interest rates to attract new clients.

4 Banks are required to use the monies deposited with them to be largely used to buy safe government bonds.

Governments want banks to put as much as possible in long-term bonds, so they do not have to soon pay off the

principal (kicking the government deficit can as far as possible down the road). Banks took in huge amounts of

deposits over the last 14 years, when government bonds in many countries were paying close to 0%, or even below 0%

interest rates. Suddenly inflation took off, and if a bond needed to be sold early it is into a 3-5% environment, meaning

early sale would cause a huge decrease in value of lower interest bonds. Due to inflation and other factors, many

depositors needed their money unexpectedly early, or if there is a lack of confidence in the bank. These safe investment

bonds in order to be sell-able need to be sold at today’s market rates. The Fed in the USA and other Central Banks did

not plan for these inevitable consequences on the macro level when they dramatically raised rates; much less at the

micro-level, for individuals, suffering from credit card and variable mortgage interest rate rises.

5 Silicon Valley Bank was the 16th largest American Bank, and Signature Bank was also quite large. If properly

reorganized and even if shut for a few days, neither would create a national or international economic collapse.

However, Citibank, Bank of America, JP Morgan Chase, and a few others are deemed so large that their collapse would

be a mega-crisis. The same is true of major investment firms. These include Solomon Brothers, Fidelity, Schwab,

Morgan Stanley, Bank of New York / Pershing and others. The key financial institutions in other countries are also

considered too important to Fail.

6 Governments, overall, are on top of this crisis and it is highly unlikely it will get out of control. Worst case is they will

create money like they did during the recent Covid lock-down period, to offset those who would do a run on a local bank

The Why?

Unlike the Financial crises of 2008, there do not seem to be bad actors that caused this

problem.

This crisis seems to have been created by two major factors, the Cryptocurrency bubble

and a crisis created by the banking system being dependent on government policy.

The Crypto bubble will likely be viewed in history books as analogous to the very first

recognized asset bubble, that of the Dutch Tulip Bulb Market beginning in 1634 with a full

collapse in 1637. Banks like Silvergate, and later Signature, thought they could act as an

honest broker creating liquidity between the Dollar and Cryptos. With major clients who did

wrong, the effects trickled down to these banks.

The interest rate mismatch that caused Silicon Valley Bank to collapse comes at the end of

a long string of Government and Central Bank decisions starting in 2020, that perhaps

inevitably destabilized the financial system. Governments needed to keep people solvent

while there were Covid lockdowns, so they used the same trick as was learned during World

War II, and used again during the 2008 financial crisis, today known as Quantitative Easing

(QE). They magically created money and handed it out, to provide the population with a

means to buy food, heat their homes and play computer games (etc.).

In order to try to re-stabilize the system, so currencies would not become worthless

(inflation), this needs to be followed by Quantitative Tightening (QT), where this new money

is withdrawn from circulation. Part of the recapture process is done by raising interest rates,

so we spend less. QT is almost impossible to do without it coming out of someone’s account

or pocket. In theory QT was coming from the hoard of low interest Treasury Bonds held by

central banks, but, importantly, also at commercial banks, insurance companies, pension funds,

endowment funds, mutual funds and numerous other institutions and wealthier individuals;

plus many countries like China and Saudi Arabia who hold their wealth in US, British and

European Bonds.

These many third party institutions are undoubtedly having difficult days. Their long-term

decisions will create changes in national and cross-border financial systems, all triggered by

Silvergate, Silicon Valley and Signature Banks. Expect to see more headlines in coming days,

especially from Europe, where there are many weak banks.

The very good news is that our clients can breathe easier than many. As advocates of

Cash Management Accounts, our American custodians do not hold their clients’ cash via long-

term Government Bonds. Cash is generally held in money market accounts, where the average

maturity of the underlying bonds is generally under a half year. These bonds are always

relatively close to the current interest rates set by the government. Further good news, our

Technical Trading system rotated investors out of the Financial sector at the end of last month.

This meltdown had no direct impact on client investments.

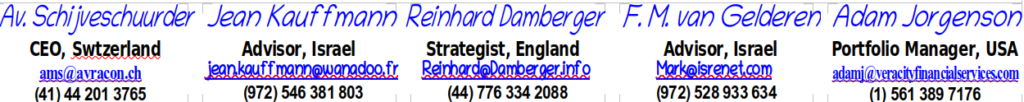

Be in touch if you need help. More than ever we feel that the kind of Money Management

systems we have been advocating for many years, are the best way to bank, save and invest.

For further assistance: calendly.com/vfs-aj